QuickBooks Small Business

Choose QuickBooks for Your Small Business

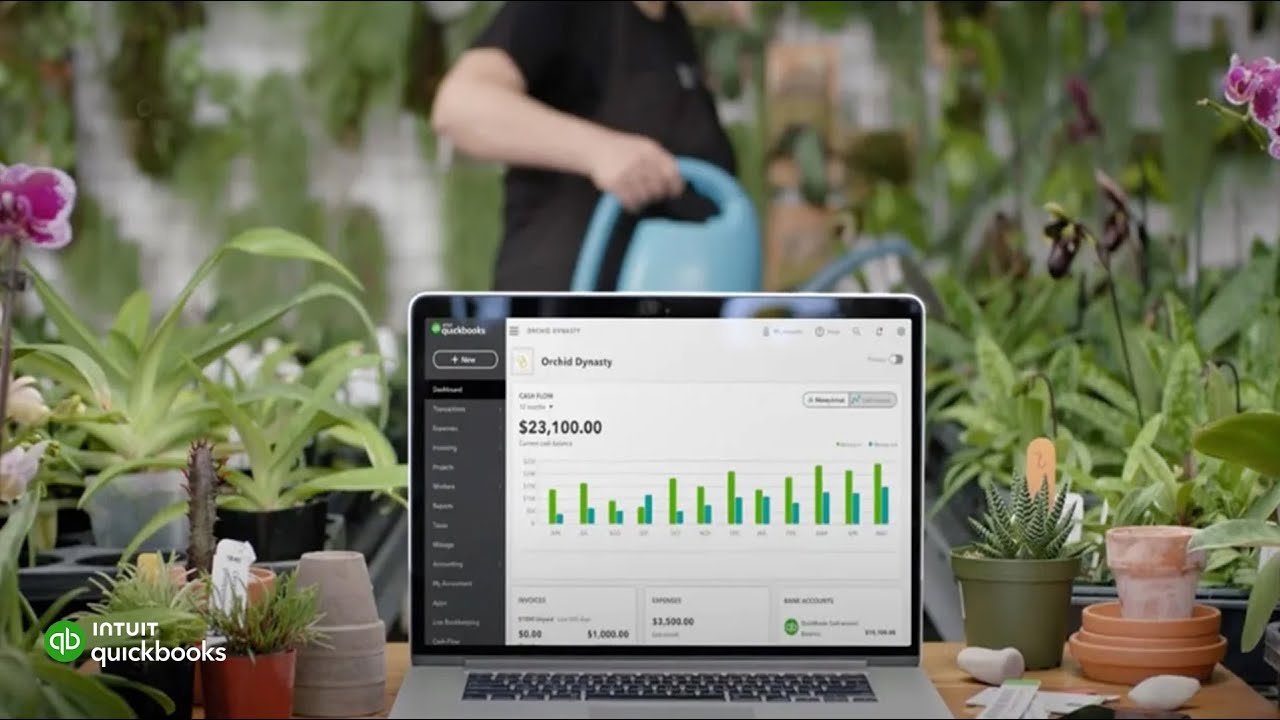

Running a small business comes with its own set of challenges, especially when it comes to managing finances. Keeping track of income, expenses, and staying on top of tax compliance can be overwhelming. That’s where QuickBooks Small Business comes in. It’s a powerful accounting software designed to simplify financial management for small businesses. In this guide, we’ll explore the features, benefits, and how QuickBooks can transform the way you handle your business finances.

Handles complex technical operations

Immediate upgrades

Best results with our Service

How does QuickBooks Small Business Benefit Different Industries

Retailers – Track sales, monitor inventory, and manage expenses effortlessly. QuickBooks helps retailers stay organized and make informed decisions.

Service-based Businesses – Easily bill clients for services rendered, track time, and manage projects with QuickBooks. It’s an invaluable tool for consultants, freelancers, and agencies.

Construction and Trades – Manage job costing, track expenses, and create professional estimates and invoices with QuickBooks. It’s tailored to meet the unique needs of contractors and tradespeople.

Healthcare Practice – From appointment scheduling to billing, QuickBooks helps healthcare professionals streamline their financial operations, allowing them to focus on patient care.

We Solve Following Issues

- Support for QuickBooks Payroll Installation Problem

- Data Base Access Related errors on QuickBooks Payroll

- File or Data Access Issues with QuickBooks Payroll

- Banking Transactions Related Issues with QuickBooks Payroll

- Online Support for Virus Removal on QuickBooks Payroll

- QuickBooks Payroll Registration issues on different PC

- QuickBooks Payroll Report Printing Related Issues

- QuickBooks Payroll Support for Software Setup

- Flash Player Installation Related Error on QuickBooks Pro

- QuickBooks Payroll Update or Upgrade Related Issues

- Server in Not Responding or other issues with QuickBooks Payroll

- Slow Ruining of System due to QuickBooks Payroll Install

- Support for Miscellaneous Error due to assertion failed